Prop Firm Essentials: Choosing the Best Payment Processing Partner

Low Rates | Secure Processing | No Setup Fees

Reviews on

4.6 of 5.0 stars

Amazing Service. The process was very easy to sign-up. Daniel at Tailoredpay was on top of his game! He made sure we were taking care of no matter what!

Thank you so much! I highly recommended Tailoredpay!

I own and operate an online company that is considered “high risk.”This was not an obstacle with Tailored Pay. They went above and beyond to provide the best rates with the best acquirers for my business. I definitely recommend any merchant to work with Tailored Pay.

Our representative was great he’s very person centered which made our business experience terrific

Great so far. Processing is working well and my representative is very helpful and surprisingly responsive.

Communication was great and they offered the lowest rate for our industry. I was talking to many different providers but TailoredPay offered many incentives, I do not regret it. Highly recommending using TailoredPay!!

Great Company easy communication and great rates

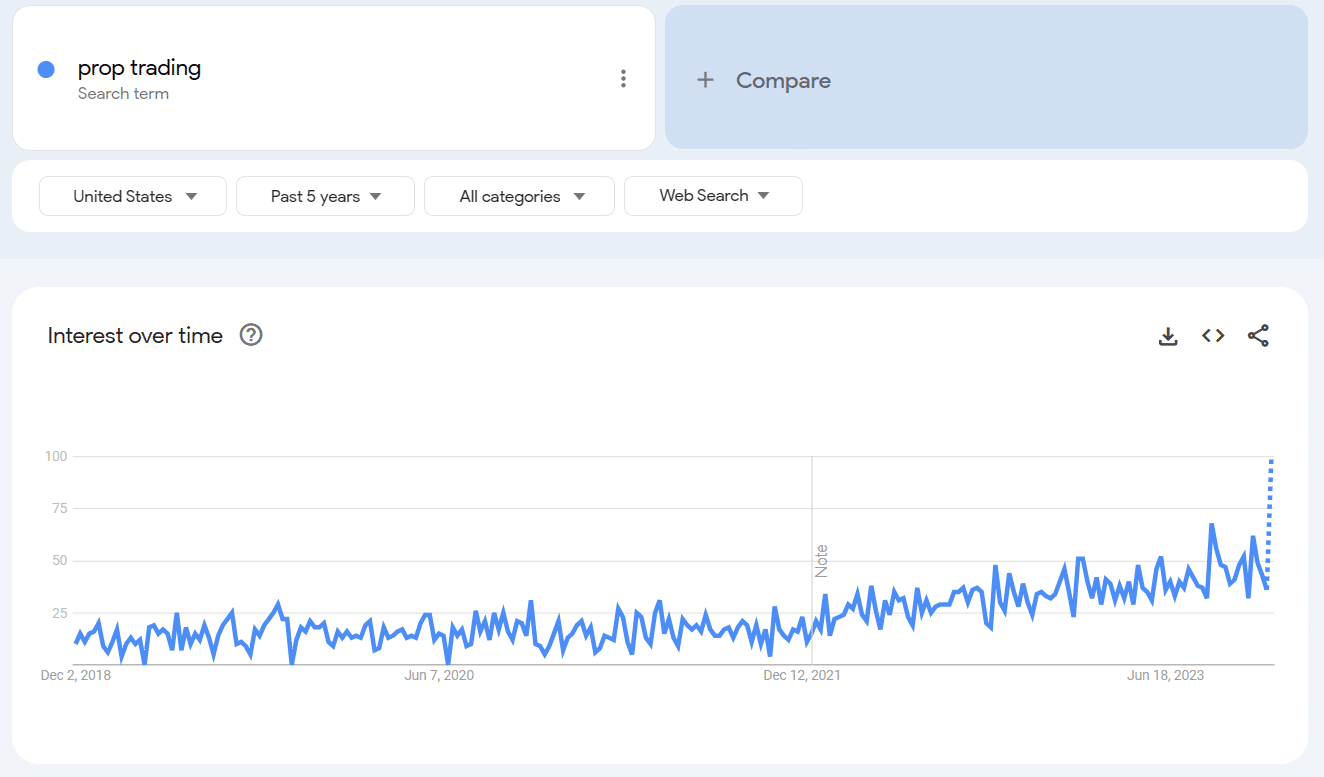

Proprietary trading (aka prop trading) is a growing industry. The use of own capital to make investments in forex, commodities, or other financial instruments is what sets prop trading apart from hedge funds.

When it comes to maximizing ROI on trading platforms, prop firms must choose the right payment processing partner – as the wrong choice can lead to transaction delays, held funds, and lost profits.

With a huge selection of payment processing options available to choose from, picking the best fit for your prop firm can be daunting. The rest of this article will offer guidance on key factors to consider when selecting the best payment processing partner for your prop trading firm.

How important is payment processing to your prop firm?

The efficiency, reliability, and security of your chosen payment processing system are critical for smooth operations within prop trading companies. Any delays, errors, or vulnerabilities in the payment infrastructure can impact trading activities, risk management, and overall profitability. This makes payment processing a critical aspect of any successful prop firm.

Identifying the best merchant account provider for your prop firm

Prop trading firms must be intentional about choosing the right merchant account partner to handle one of the most crucial aspects of their operations – payment processing.

A reliable partner can help streamline operations through quick, efficient, and secure transaction processing. Here are some factors to consider when choosing the right payment processing partner for prop trading:

- Experience – Look for a payment processing partner with a proven track record in the financial market. They should have experience working with high volume transactions in the global macro trading space, and understand the unique needs and challenges of prop firms.

- Security – Security is of utmost importance when it comes to payment processing. As you’re not a hedge fund, choose a partner that uses the latest security protocols and encryption technologies to protect your transactions and every trader’s data.

- Cost – Payment processing fees can vary widely between providers. Look for a partner that offers competitive rates and transparent pricing.

- Integration – Your payment processing partner should be able to seamlessly integrate with your checkout page and other systems. This will help streamline your operations and reduce the risk of errors or delays.

- Long-Term Scalability – Can your chosen partner support the business’s growth and evolving needs over time? Will the partnership be sustainable and beneficial in the long run?

- Speed and Liquidity: Swift payment processing ensures liquidity. Can your selected partner provide quick access to funds that prop firms need to fund their traders?

Oops, I picked the wrong payment processor

If you’ve already engaged the services of a payment processor, but aren’t getting full value for your money, you may have picked the wrong partner.

Some red flags that might indicate that you have chosen the wrong payment processing partner for your prop trading firm include:

- Increased Risk Exposure: An unreliable payment processor might have security vulnerabilities or operational issues, exposing prop firms to the risk of fraud, data breaches, or financial losses. This could damage your firm’s reputation and lead to financial liabilities.

- High Reserve Requests: Another warning sign that you may have chosen the wrong payment processing partner for your prop trading firm is when the processor consistently requests a high reserve. While reserves are a common practice in the industry, an excessively high reserve requirement can tie up your firm’s capital and limit its ability to scale. A partner that continually demands a substantial reserve might not be the perfect fit for your business’s growth ambitions.

- Deposit Issues and Delays: Another warning sign that you may have chosen the wrong payment processing partner for your prop trading firm is when you consistently encounter deposit issues and delays. Prop trading firms rely on seamless and timely deposits to fund their traders. A payment processor that struggles with deposit processing can disrupt your firm’s operations, hinder trading activities, and potentially lead to financial setbacks.

Making the final decision

After weighing the pros and cons of each potential prop trading payment processing partner, you need to make a decision. This decision should not be taken lightly, as it will have long-term implications for your overall success.

One useful way to make the final decision is to create a list of the pros and cons of each potential partner. This list should include factors such as fees, reliability, security, customer service, and any other important considerations.

It may be helpful to assign a weight to each factor based on its importance to the business. For example, if low fees are a top priority, that factor may be assigned a higher weight than others.

Once the list is complete, review it carefully and consider each factor in relation to the business’s specific needs and goals.

TailoredPay is one of the best payment processing partners for prop trading firms

With years of experience in the financial industry, TailoredPay offers a reputable, secure, and affordable payment processing solution that meets the demands of prop trading firms.

On the technology infrastructure front, we provide prop firms with rapid transaction processing speed, chargeback mitigation, fraud prevention, and multiple integration options.

As your selected payment processing partner, we also provide real-time reporting and analytics to support informed decision-making. Our competitive pricing, speedy digital application process and chargeback prevention system make us the ideal partner for prop firms aiming for success.

Conclusion

Ultimately, your choice of the best payment processing partner for your prop firm should be based on a careful consideration of all factors and a clear understanding of the business’s unique needs and goals.

With TailoredPay, your prop trading business can thrive and achieve long-term success more competitively, with reduced risk and optimal service delivery. If you’re interested in taking the step towards reliable payment processing, get started now.

Solutions as unique as

your business.