Table of Contents

- What is a high-risk merchant account?

- What is the difference between high-risk and low-risk merchant accounts?

- Chargebacks and high-risk merchant accounts

- Who needs a high-risk merchant account?

- What are common high-risk business types?

- Why you need a high-risk merchant account

- How do I apply for a high-risk merchant account?

- How long does it take to set up a high-risk merchant account?

- What are the high-risk merchant account fees?

- Pros and cons of high-risk merchant accounts

- How to protect your high-risk merchant account

- How TailoredPay can help

- High-risk merchant accounts: Frequently asked questions (FAQs)

If you are a high-risk merchant, finding a payment processing company that will work with you can be challenging. That’s because high-risk merchants have an increased risk of chargebacks and fraud, making traditional banks less likely to accept them.

In some cases, that leads to high-risk merchants accepting higher fees and poor service because they think that’s all they can get. However, that doesn’t have to be the case.

By understanding what makes a merchant “high-risk” and how the high-risk payment processing industry works, you can intelligently navigate your options and make an informed decision that keeps more money in your pockets.

In this ultimate guide to high-risk merchant accounts, we’ll take a deep dive into the high-risk payment industry and give you the information you need to protect your bottom line.

What is a high-risk merchant account?

A high-risk merchant account is a payment processing account for businesses that traditional payment processors classify as high-risk.

High-risk refers to a higher probability of chargebacks or fraud than traditional businesses. Criteria like transaction size, industry, sales model, and order fulfillment timeframes can also influence if a merchant is classified as high-risk.

Once a business is classified as high-risk, securing payment processing can be expensive or even completely out of reach with traditional financial institutions.

That’s where TailoredPay comes in. As a leading high-risk merchant account provider, we have relationships with processors and industry expertise to provide your business with cost-effective solutions.

How much does a high-risk merchant account cost?

Rates vary but are often around 3-4% for high-risk merchants.

A high-risk merchant account generally costs more than a traditional account. For processors, the higher cost mitigates the increased risks. Rates are often around 3-4% for high-risk merchants, but high-risk merchant account fees vary based on the pricing model.

With rates starting at 2.6% with no hidden fees, TailoredPay offers high-risk businesses exceptional value and transparent pricing. Use our interactive slider tool to determine how much money you can save with TailoredPay.

What is the difference between high-risk and low-risk merchant accounts?

Risk to the acquiring bank is the fundamental difference between high and low-risk merchant accounts.

As the name implies, low-risk businesses generally carry less risk for the acquiring bank.

Common characteristics of low-risk businesses are:

- Long business history

- Sale of physical goods

- Low rates of fraud and chargebacks.

Some examples of low-risk businesses are:

- Brick-and-mortar retail stores

- Service businesses

- Restaurants

Conversely, a business may be considered high-risk for a variety of reasons. Common characteristics of a high-risk business are:

- Negative credit history

- Recurring billing or free trials

- Sale of high-ticket items

- High rates of fraud or chargebacks

Is your business high risk?

Credit, sales model, and industry are key indicators to determine high-risk status.

If you operate in a high-risk industry, have bad credit, use recurring billing, issue free trials, or sell high-ticket items, there’s a good chance traditional banks will label your business high-risk.

If you’re not sure whether your business is high-risk or low-risk, contact TailoredPay today. Our payment processing experts can help you categorize your business and understand your options.

Chargebacks and high-risk merchant accounts

High-risk businesses often have a high rate of chargebacks. While the exact definition of “high rate” varies, many merchant accounts are set up with a stipulation that the chargeback ratio does not exceed 0.9%.

A chargeback is a transaction that is reversed due to a dispute between the customer and the merchant. Chargeback reason codes provide high-level detail on the reason for a chargeback. Chargebacks can be caused by fraudulent activity, but they can also result from customer dissatisfaction or errors on the merchant’s part.

High-risk businesses are more susceptible to chargebacks because they often sell digital goods or services that can be difficult to track and verify. Additionally, high-risk companies may have customers that are located all over the world, which can make it more difficult to resolve disputes.

How can you reduce chargeback risk?

TailoredPay can help you manage chargebacks with industry-leading fraud prevention tools. A chargeback prevention program can save you time and money with real-time notifications as soon as a customer files a dispute, allowing you to issue a refund or resolve the issue.

Who needs a high-risk merchant account?

You’ll likely need a high-risk merchant account if you’re in a high-risk industry. Additionally, criteria like transaction size, credit, sales model, and order fulfillment timeframes might create a need for a high-risk merchant account.

However, there’s no one-size-fits-all answer to this question. To help you better classify your business, let’s look at some common reasons why businesses are classified as high-risk.

Bad credit

Businesses with bad credit (or no/limited credit history) are often classified as high-risk.

Generally, banks and payment processors view bad credit and no credit as increased risk of default. With consumer credit, increased risk leads to things like higher interest rates and lower approval rates on credit cards and loans. Similarly, in the world of merchant accounts, the increased risk leads to a high-risk classification with higher fees and lower approval rates.

What does it mean to have “bad credit”?

A PAYDEX score of 49 or lower or an Intelliscore Plus score of 10 or lower indicates bad business credit.

“Bad credit” implies your business has a high risk of defaulting on payments and is quantified by your credit score. While FICO consumer credit scores range from 300-850, business credit scores are usually on a 1-100 scale.

The two most popular business credit scores are the PAYDEX Score and Experian Intelliscore Plus. Intelliscore Plus scores of 76 or higher are low risk, while scores of 1-10 are high risk. With PAYDEX scores, 80 or higher is low risk, while 1-49 is high risk.

Like consumer credit scores, multiple factors can lead to bad business credit, including:

- Late or missed payments

- Defaults on loans

- High levels of debt

Free trials

If your business offers free trials that upgrade to paid subscriptions, it might be a high-risk business. That’s because free trials can increase your risk of chargebacks and fraud in two ways:

- Legitimate users may forget to cancel a trial and file a chargeback.

- Fraudsters may sign up for multiple free trials and cancel before the trial period ends.

That can be a double whammy for businesses. Not only do you lose out on the revenue from the subscription, but you also incur transaction costs. Because of these risks, providers often classify businesses offering free trials as high-risk.

Recurring billing

Subscriptions and other forms of recurring billing are often labeled high-risk by traditional payment processors. The logic is similar to what makes free trials high risk. Customers might forget about the subscription and then file a chargeback later.

High-ticket sales

Businesses that sell high-ticket items may be considered high risk. Examples of high-ticket items are:

- Cars

- Jewelry

- High-end electronics

With these purchases, there is a greater risk that the customer will dispute the charge if they are unhappy with the product or service. There is also the risk that the customer will want to cancel their purchase after receiving the product.

💡Pro-tip: Chargeback mitigation tools alert you to disputes in real time, giving you more control and visibility over chargebacks.

High rates of fraud or chargebacks in your industry

As you might expect, your business will likely be labeled high-risk if you operate in an industry with above-average fraud or chargebacks.

For example, businesses that sell digital goods or services are often classified as high-risk because it can be difficult to verify a customer’s identity and track the product or service, which increases payments disputes.

Processing history

Payment processors will often look at your processing history to determine your risk level. Your processing history shows the most frequent payment types you accept, which may include international credit or debit cards. International cards are often associated with high-risk businesses, as they are more difficult to verify.

Your processing history may also show high rates of chargebacks or refunds. A high rate of customer complaints is usually a red flag for payment processors.

What are common high-risk industries?

Why you need a high-risk merchant account

Now that you have an idea of what makes a business high-risk, you may wonder why you need a high-risk merchant account instead of a traditional one. In many cases, the answer is you simply can’t get a merchant account from a traditional provider. Alternatively, the risk of termination with a traditional payment processor may be a poor business choice.

Further, high-risk businesses need specialized payment processing services to protect themselves from fraud and chargebacks. Quality payment solution providers like TailoredPay can provide several features and benefits that help your business reduce risk and increase profits, including:

- Chargeback prevention tools: Prevent chargebacks.

- Fraud monitoring and prevention: Stop fraudsters in their tracks.

- Identity verification: Verify your customers’ identities to reduce fraud.

- Data security: Keep your customer data safe and secure.

- Payment gateway security: Protect your business from online threats.

Can’t I just use any merchant account?

No, in many cases a traditional merchant account isn’t enough.

If you’re a high-risk business, you’ll need more than a traditional merchant account offers. Many payment processors simply won’t accept a merchant they deem as high-risk. You need a high-risk merchant account designed for higher-risk businesses.

Additionally, traditional merchant accounts often don’t come with the same level of protection against fraud and chargebacks, and they may be unable to process the high volume of transactions.

What about payment processing alternatives like PayPal, Square, Stripe, or Venmo?

These platforms often make it difficult for — or outright prohibit — high-risk industries.

Payment processing alternatives like PayPal, Square, Stripe, or Venmo may seem like an easy option. However, these platforms have tight restrictions on what businesses they allow. High-risk businesses such as tobacco sales, adult entertainment, firearms sales, and more may be prohibited.

With a quality high-risk merchant account, you won’t be rejected just because you operate in a high-risk industry. You’ll also have access to fraud prevention tools, chargeback mitigation, and dedicated customer service from experts who understand your industry’s needs.

How do I apply for a high-risk merchant account?

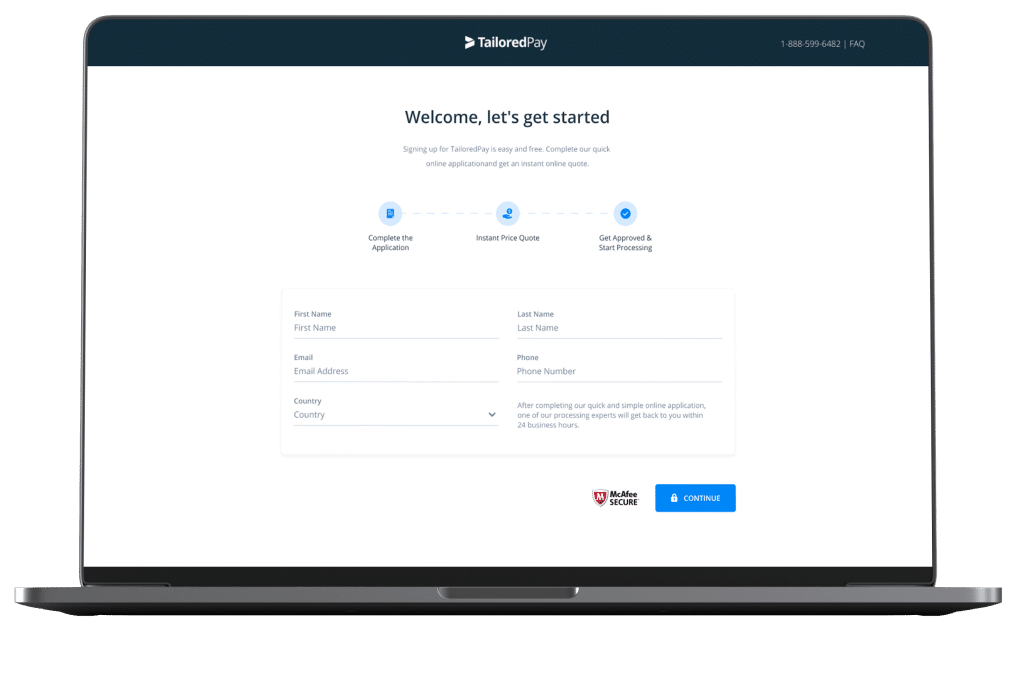

The process varies across different high-risk merchant account providers. At TailoredPay, we pride ourselves on our quick and simple application process. Here’s a simple how-to for getting started:

Documents required for a high-risk merchant account

Getting a high-risk merchant account with TailoredPay is easy and convenient. If you are applying for a U.S. merchant account, you need to include the following documents with your application.

After you submit your online application, you will be contacted by one of our processing experts within 24 hours.

How long does it take to set up a high-risk merchant account?

The average approval time for a U.S. merchant account with TailoredPay as your high-risk merchant services provider is between 2 and 3 business days. Occasionally, the underwriter might request additional information. This can extend the timeframe for new account approvals but typically only adds another two days to the process.

What are the high-risk merchant account fees?

High-risk merchant accounts generally come with higher fees than low-risk accounts. However, if you know what to look for, you can get reasonable rates and retain more of your profits.

Additionally, the lower the reserves a provider requires, the more cash flow you have available for your business. When you’re searching for high-risk merchant account providers, be sure to understand these different fees and pricing models and compare them across providers:

- Interchange-plus pricing: This is the most transparent pricing model and gives you the most control over your costs.

- Transaction fees: These are typically a fixed percentage of each transaction.

- Chargeback fees: These fees are charged when a customer disputes a charge with their credit card issuer.

- Account fees: Most high-risk merchant account providers charge a monthly fee, which covers the cost of your account and access to customer support.

- Reserve requirements: A merchant account reserve is a percentage of your credit card sales the provider holds onto in case of chargebacks or other disputes.

Pros and cons of high-risk merchant accounts

You should consider a few things before applying for a high-risk merchant account. Some drawbacks of having a high-risk account are higher processing fees and reserve requirements compared to traditional merchant accounts.

However, the upside of a high-risk merchant account can be significant if you can find the right provider. The right payment solutions provider can help you limit fees, reduce fraud, and scale to meet market demand.

With TailoredPay, the pros far outweigh the cons. Here are some of the benefits you’ll enjoy with a high-risk merchant account provided by TailoredPay:

- Security and protection. Because of the nature of the industry, high-risk merchant accounts usually have better security and protection against fraud and chargebacks.

- Scalability. You’ll be able to accept multiple payment types, including credit and debit cards, ACH payments, and eChecks.

- Competitive rates with no hidden fees. We offer competitive pricing with rates based on your business’s unique needs. We’ve also eliminated miscellaneous fees, so you’ll know exactly what you’re paying for every transaction.

- Dedicated support. You’ll have access to our team of experts who are ready to help you with any questions or concerns you may have.

How to protect your high-risk merchant account

You can do a few things to protect your high-risk merchant account from suspension and keep your account in good standing.

Keep accurate records of all your transactions

Accurate records help you resolve any disputes quickly and efficiently. By keeping track of all transactions, you can ensure that you are getting paid for the products and services you provide. As a bonus, a paper trail also comes in handy during disputes.

Enable chargeback alerts

When it comes to credit card fraud, prevention is key. With chargeback alerts, you will be notified as soon as a chargeback is filed. This allows you to investigate the transaction and, if necessary, refund the customer before the chargeback is processed.

Chargebacks can be costly for businesses. Chargeback alerts can help reduce that cost. In addition, chargeback alerts can help businesses track fraud trends and prevent future fraud.

Mitigate fraud

Chargeback alerts are a big part of fraud prevention but are not the only step you should take. Here are some other key fraud mitigation techniques:

- Investigate unusual declines. Multiple “transaction declined by issuer” or similar declines can be red flags. If you notice multiple declined payments for a card, check if there are any unusual trends. For example, a single IP address using multiple physical addresses is a common indicator of card fraud.

- Scrutinize transaction spikes. A sharp increase in transactions you can’t explain could indicate criminals attempting to use stolen credit card information on your site. If you notice a spike, investigate it to verify its legitimacy.

- Use 3D Secure. 3D Secure (3DS) refers to three domains involved in card payments: the issuer, the merchant, and the 3DS network that provides security. With 3DS, you add a form of two-factor authentication to payments and reduce fraud risk.

- Partner with a secure payment processor. Your payment processor can help you mitigate online fraud. At a minimum, they should offer things like CCV and address verification to reduce fraud risk. Ideally, they should serve as your trusted advisor and provide expert advice.

Follow industry regulations

Every business is subject to regulations, which vary depending on industry and location. In some cases, businesses may be required to obtain a license or permit before they can begin operating. They may also be subject to regular inspections to ensure that they are complying with all relevant regulations.

Failure to comply with industry regulations can result in significant fines or even a business shutdown. Therefore, businesses must familiarize themselves with the regulations that apply to their industry and ensure they are always in compliance.

At a minimum, merchants processing card payments online must comply with PCI DSS (Payment Card Industry Data Security Standard). Merchants that fail to comply can be barred from processing payments on the major credit card networks. Fortunately, the right payment gateway can significantly reduce the complexity of PCI DSS compliance.

Partner with experts

The best way to protect your high-risk merchant account is to partner with a payment processor specializing in high-risk accounts. The right merchant account provider can help you navigate the complexities of high-risk payment processing and find an ideal solution for your business.

Choosing the wrong provider can lead to unnecessary fees, more chargebacks, and an increased risk of merchant account termination.

How TailoredPay can help

As a leading high-risk merchant account provider, we can help you secure payment processing so your business can grow and thrive. We specialize in providing reliable and affordable high-risk payment processing solutions to high-risk merchants. We have the tools, resources, and expertise to help your business succeed!

What makes TailoredPay different

We understand high-risk businesses’ unique needs and are here to help you succeed. With a high-risk merchant account from TailoredPay, you can expect:

- Customized solutions: Our experts will help you find the best pricing model for your business, whether it’s interchange-plus, flat rate, or tiered. Starting at just 2.6%, TailoredPay offers the best rates in the high-risk payment processing industry.

- Chargeback mitigation and prevention: Chargeback alerts and monitoring give you the information you need to prevent and resolve chargebacks quickly.

- Complete transparency and no miscellaneous fees: You won’t see any unexpected costs with TailoredPay. We believe in total transparency, so you’ll never be charged for something you didn’t agree to upfront.

- Reasonable reserve requirements: With low reserve percentages, you’ll have more cash flow for your business.

When you partner with TailoredPay, you get industry-leading expertise and affordable high-risk merchant account services. We are dedicated to providing our merchants with the tools and resources they need to succeed.

| TailoredPay |

|---|

| Digital application process |

| Approvals within 48-72 hours |

| No setup fees |

| Wide range of industries accepted |

| Focus on high-risk merchants |

| Chargeback prevention system |

| Traditional Providers |

|---|

| Digital application process |

| Approvals within 48-72 hours |

| No setup fees |

| Wide range of industries accepted |

| Focus on high-risk merchants |

| Chargeback prevention system |

High-risk merchant accounts:

Frequently asked questions (FAQs)