TailoredPay is different.

TailoredPay is different.

We offer tailored payment processing solutions to help scale your business.

- Free rate review & comparison

High risk industries supported

Seamless integration with 3rd party softwares

Reduce chargebacks with anti-fraud tools

Calculate your savings:

What is your monthly processing volume (revenue) in $ e.g. if your monthly volume is $20,000, drag the slider to $20,000

Accept payments

easily

Start accepting payments any way you want – Visa, MasterCard, American Express, and Debit Cards, all with transparent pricing and the latest security features. See deposits in your bank account as soon as the next business day.

Accept payments online, over the phone, or in-person.

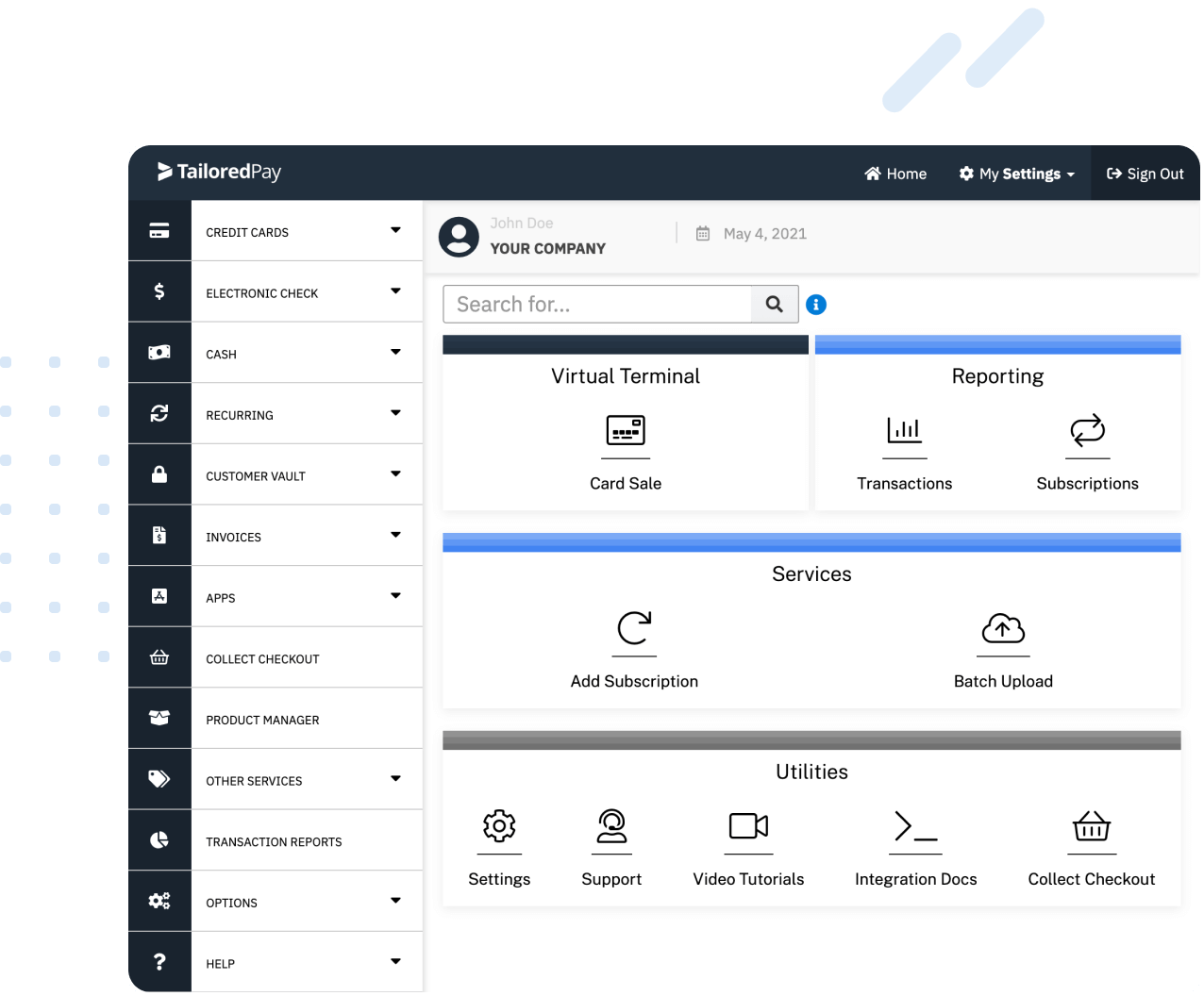

Payment platform designed to increase your revenue.

Process card transactions with a virtual terminal

Recurring payments and subscriptions supported

Advanced dashboard to manage returns and disputes

Honest pricing and no hidden fees

Seamless platform integration

Apply below to start saving

It only takes 1 minute…

Frequently Asked Questions

A payment gateway is a technology that processes credit card payments for both e-commerce and traditional brick-and-mortar stores. It sends a customers’ credit card data to the merchant bank (acquirer bank) and within a few seconds the payment gets either accepted or declined. This happens through

– virtual payment processing on the checkout page of your website or

– physical POS terminals in your brick-and-mortar store

A high-risk payment gateway is a payment processing service that is designed to handle transactions for businesses or industries that are considered high-risk by banks and traditional payment processors. High-risk payment gateways have specialized features to manage the unique risks associated with these industries, such as fraud mitigation and chargeback prevention tools.

A high risk payment gateway is often necessary for businesses that deal with high-risk transactions or have a higher likelihood of fraudulent activity. This particularly applies to online businesses, which usually process card-not-present transactions.

Some industries that often require high-risk payment gateways include:

- Nutraceuticals or supplements

- Online gambling or gaming

- Adult entertainment

- Travel

High-risk payment gateways specialize in managing the risks associated with these industries and can offer higher levels of fraud protection and security measures.

Typically, the cost of using a payment gateway is a combination of fees, including a setup fee, a transaction fee, and a monthly fee. Payment gateway fees range between $10-25 per month plus $0.05-$0.10 per transaction, depending on the payment gateway provider. Popular payment gateway providers are Authorize.net and NMI. In addition, a daily batch fee of $0.05-0.10 is charged for aggregating all transactions from the past 24 hours into a single “batch” and sending them to the processing networks.

A payment gateway provider is a company that offers businesses a payment gateway to process electronic payments, such as credit card or direct payments, securely and efficiently. Payment gateway providers act as intermediaries between the merchant and the financial institutions involved in processing the payment, such as the customer’s bank or credit card company. Payment gateway providers include companies such as PayPal, Stripe, Authorize.net, Square, and many others.

A payment gateway is a technology that processes payments by verifying the customer’s payment information and transmitting it securely to the merchant acquiring bank. Within a few seconds, the payment gateway receives a notification from the bank indicating whether the payment has been accepted or declined. This notification is then relayed back to the customer either through a physical point-of-sale (POS) terminal or online checkout page.

Here is a simplified explanation of how a payment gateway works:

- Customer initiates a payment: The customer begins the payment process by entering their payment information, such as credit card details or bank account information, on the merchant’s website or application.

- Payment information is transmitted: The payment information is then transmitted from the website or application to the payment gateway provider.

- Payment gateway provider processes the payment: The payment gateway provider securely captures and stores the payment information, and then forwards it to the appropriate financial institution, such as the customer’s bank or credit card company.

- Approval or decline of the payment: The financial institution verifies the payment information and either approves or declines the transaction. If the transaction is approved, a payment acceptance notification back is send back to the payment gateway provider.

- Payment gateway provider sends notification to the customer: The payment gateway provider receives the payment acceptance or decline notification from the financial institution and sends it back to the merchant’s website or application, which then notifies the customer of the payment status.

In summary, a payment gateway acts as a secure intermediary between the merchant, the customer, and the financial institution to ensure that electronic payments are processed accurately and efficiently.

You can do several things to reduce the number of chargebacks your business receives. Here are three essential tips:

- Ensure that you only ship products to confirmed addresses

- Keep detailed records of all customer interactions (they will come in handy if you ever need to dispute a chargeback claim).

- Use fraud prevention measures like Address Verification Service (AVS) or Card Verification Value (CVV).

Most merchant accounts are set up so that your chargeback ratio does not exceed 0.9%. If you go over this limit, your account could be automatically terminated.

A chargeback threshold is a percentage (of transactions or overall revenue) that your customers might ‘charge back’ before the merchant account is red-flagged for closure.

Whenever a customer files a chargeback claim, they need to explain to their credit card company why they are doing so. These reasons are known as chargeback codes. There are four main chargeback codes: quality, clerical, technical, and fraud.

- Quality covers things like receiving substandard or faulty products. It also covers cases where the customer never received their purchased item.

- Clerical chargebacks include duplicate billings, over-excessive service charges, and non-issued refunds.

- Technical chargebacks may be filed if the customer doesn’t have enough credit remaining on their card for the purchase to go through or if there was a processing error during the transaction.

- Lastly, and most commonly, fraud chargebacks apply when someone else made a purchase using the customer’s card. As you can likely already guess, these chargebacks are the most common because they are very difficult to disprove. Quality chargebacks are also fairly common, although these are slightly easier to dispute in many cases.

There are multiple reasons why processors may classify businesses as high-risk. These include the following circumstances:

- You have a negative credit history.

- You offer recurring billing or a free trial.

- You sell high-ticket items.

- The industry you operate in has a high rate of fraud or chargebacks.

We currently work with US-based businesses and accept merchants that are classified as high, medium, or low-risk.

A high-risk merchant is a business that carries more risk for banks and payment processors. High-risk merchants have unique needs that are different from traditional or low-risk merchants. TailoredPay has the tools, resources, and expertise to provide high-quality payment processing services to high-risk merchants.

High-risk merchant accounts are payment processing accounts tailored to businesses classified as high-risk by traditional providers.

A merchant category code (MCC) is a four-digit number that is assigned to merchants. MCCs are defined in the ISO 18245 standard. The codes can be used for classifying merchants and transactions, tax reporting, tracking spending (e.g., points programs), and other payment processing workflows.

The cost of a merchant account will depend on your business type, monthly sales volume, and average transaction size. Typically, high-risk merchant accounts come with higher fees than traditional merchant accounts.

If you are applying for a merchant account, you will need to include the following documents with your application:

- Copy of your Passport, Driver’s License or government-issued ID

- Voided check or bank letter

- If applicable, 3 months of most recent credit card processing statements from your previous or existing provider

- 3 months of most recent business bank statements. If the business is new, 3 months of most recent personal bank statements are required

Our online merchant account application process is quick and simple. In total, it should only take around 10-15 minutes:

- Complete the online application (~10 minutes).

- DocuSign the merchant processing agreement (3-4 minutes).

- Start processing payments if your application has been approved (24-72 hours).

In most cases, it will only take 24-48 business hours to receive a deposit.

No. Many high-risk merchant account providers will charge you a fee to set up your account, but we want to make our services accessible to everyone.

The exact rate will vary depending on the classification of your business (low, medium or high-risk). Once you complete our online application, you will receive an instant quote via DocuSign. We always try to save our merchants money on payment processing fees by eliminating miscellaneous fees.

A chargeback occurs when a cardholder disputes a transaction on their account. When this happens, the bank that issued the credit card investigates the matter on behalf of the cardholder.

Upon discovering a fraudulent transaction, the issuing bank returns the funds to the cardholder. If a merchant cannot prove that the transaction is legitimate, the processor will subtract the amount of the transaction in question from the merchant’s bank account.