Credit card fraud costs enough money each year to permanently relocate 4 politicians to Mars

Reviews on

4.6 of 5.0 stars

Amazing Service. The process was very easy to sign-up. Daniel at Tailoredpay was on top of his game! He made sure we were taking care of no matter what!

Thank you so much! I highly recommended Tailoredpay!

I own and operate an online company that is considered “high risk.”This was not an obstacle with Tailored Pay. They went above and beyond to provide the best rates with the best acquirers for my business. I definitely recommend any merchant to work with Tailored Pay.

Our representative was great he’s very person centered which made our business experience terrific

Great so far. Processing is working well and my representative is very helpful and surprisingly responsive.

Communication was great and they offered the lowest rate for our industry. I was talking to many different providers but TailoredPay offered many incentives, I do not regret it. Highly recommending using TailoredPay!!

Great Company easy communication and great rates

If you had to vote to send 4 politicians on a one-way trip to Mars, who would earn your vote? A senator? Speaker at the House of Reps? Or the main man himself? As crazy as it sounds, the idea of launching politicians into space isn’t new. And there are plenty of potential sources for the funding. In fact, criminals are stealing the equivalent funds required for this noble project each year from our credit cards.

Suppose our banks could aggregate all these stolen credit card funds into a big money pot. We would be able to launch our biggest political problems into Mars. But first, why does credit card fraud cost us so much?

In many ways, the U.S. is the epicenter of credit card fraud targeting. A Nilson report from December 2021 indicated the U.S. accounted for a disproportionate amount of credit card fraud. The report found that the U.S. accounted for 22.4% of credit card volume in 2020, while also accounting for over 35% of credit card fraud. As more people have stayed home and made online purchases, experts have predicted that fraud will increase significantly.

The quick lesson here for eCommerce merchants is: you must be sufficiently prepared to protect your businesses and customers from financial losses due to credit card fraud.

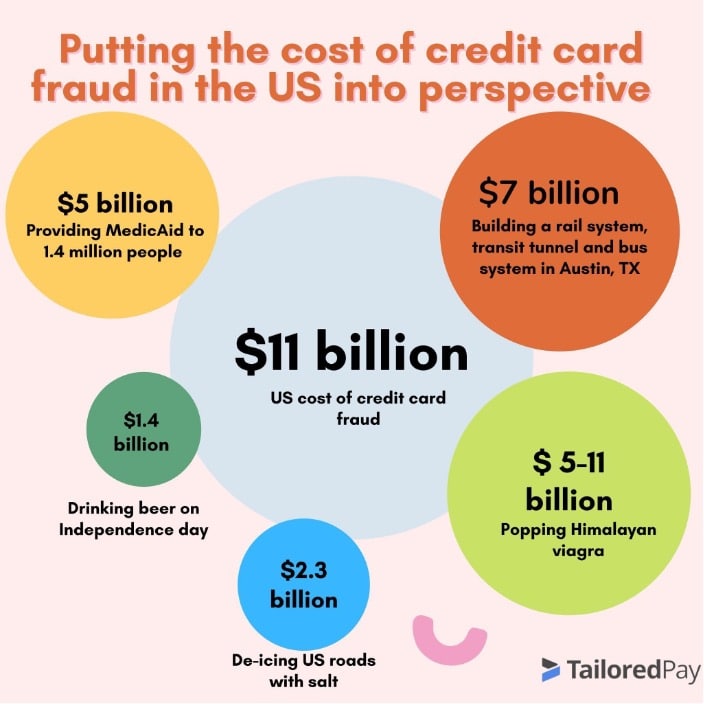

According to the Nilson report, the amount that businesses lost to credit fraud globally reached an eye-watering $28.58bn in 2020. While this number is down slightly from 2019 ($28.65bn), numbers are expected to increase along with cross-border spending post-pandemic. In addition to the staggering costs in the Nilson report, Julie Conroy, a research director in the fraud and anti-money laundering practice at Aite Group, estimated the U.S. saw about $11bn in losses related to credit card fraud.

This estimated annual loss to credit card fraud is enough to fund healthcare projects, infrastructure projects, and even send 4 politicians of your choice to Mars forever. To help us understand the staggering losses to credit card fraud, let’s take a look at the breakdown below.

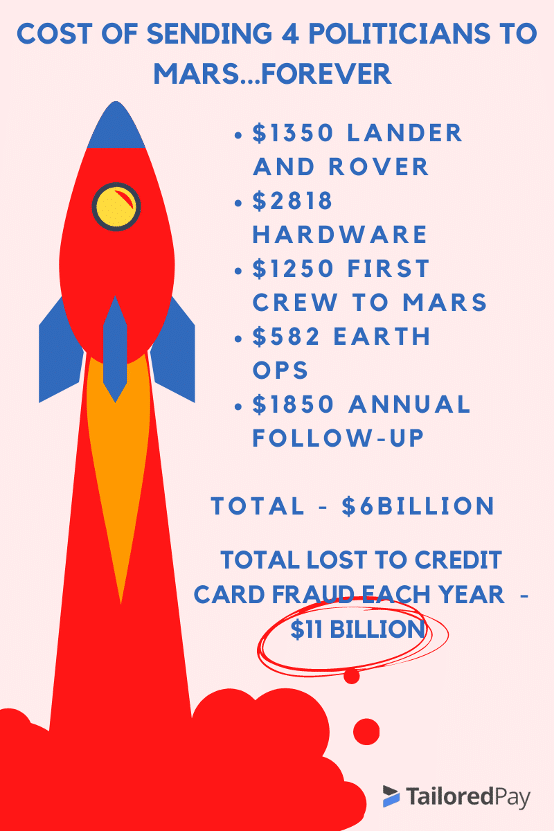

Now, let’s have some fun and focus on sending our collective pains in the rears to Mars. According to the Mars colonization project MarsOne, it will cost $6 billion to send 4 people on a one-way trip to Mars. This means that around half of the money lost to credit card fraud could be used for the good of humanity by sending our most problematic species away for a long time.

Here’s exactly how $6bn can be spent to achieve this noble goal:

- $1,350 million – first unmanned lander & rover mission

- $2818 million – ground hardware – communication satellite, stations, outpost supplies

- $582 million – Earth-based operations such as astronaut training and recruitment

- $1250 million – sending the first crew to Mars

This comes to a total of $6 billion, leaving an extra $5 billion for the rest of us to drink Independence-day levels of beer in celebration – with plenty more leftover.

What exactly is credit card fraud, and how bad is the problem?

Simply put, credit card fraud occurs when a criminal gains access to a person’s credit card information, which they subsequently use to make unauthorized purchases.

The rapid growth of e-commerce in the US makes it easy and convenient to use credit cards to purchase goods and services. The adoption of credit cards as a dominant means of payment in the US also appeals to fraudsters who continually evolve their criminal techniques to evade detection by customers and card processing companies. Card-not-present (CNP) fraud has become the major contributor to credit card fraud in the US, representing 75% of all cases. This creates a need for all affected parties to be one step ahead of the fraudsters, carrying out transactions vigilantly with secure infrastructure, systems, and processes.

Effect of credit card fraud on e-commerce merchants

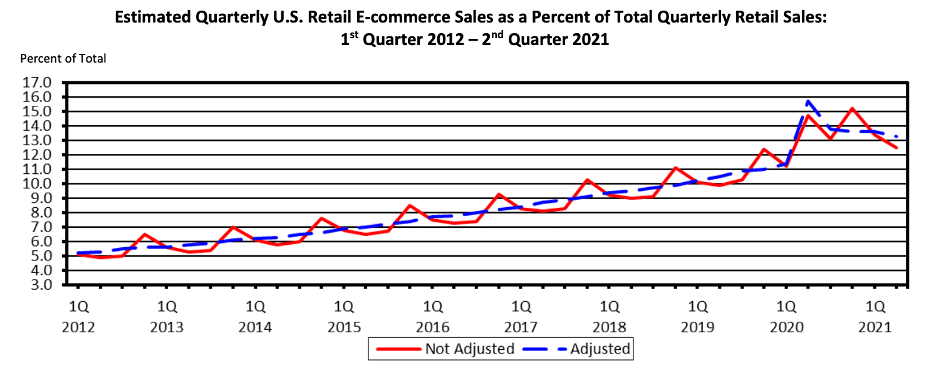

Thanks to us buying more goods online, eCommerce merchants are seeing a consistent increase in sales through online channels.

Source: Census.gov

On the other side of this coin is the fact that with increased sales comes an increased potential for credit card fraud. The additional risk has a negative impact on consumers, eCommerce merchants, and payment processors.

For example, when an unauthorized transaction is made with a compromised credit card, the customer first contacts the bank. The bank subsequently initiates a chargeback, freezing the funds and requesting further information. The process of initiating a chargeback comes at a cost to the merchant. To top it off, merchants that incur a high number of chargebacks are deemed ‘risky’ and may have their merchant accounts restricted. This is much more likely to occur if their merchant accounts are not held with high-risk merchant account processors.

Additionally, eCommerce merchants also suffer losses when goods that have been fraudulently paid for, are shipped to customers before chargebacks are initiated. This is not unusual, especially for eCommerce merchants that ship quickly. Usually, the item(s) ‘purchased’ by the fraudster are not returned, and the merchant gets stung by the cost.

How to mitigate credit card fraud as an e-commerce merchant

With the increased frequency of credit card fraud, merchants must be prepared to mitigate the risk of potentially fraudulent transactions. Here are some measures you can take as an eCommerce merchant to protect your customers and avoid getting stung by credit card fraudsters.

- Choose a secure, supportive payment processor. As an eCommerce merchant, your choice of a payment processor is your number one tool for mitigating credit card fraud. Choose a PCI-compliant payment processor that offers fraud prevention measures such as CCV, address verification, etc.

- Get an SSL certificate. An SSL certificate helps you secure your payment page, so it is important to get one in your name.

- Manually assess unusual declines. For multiple declined payments on the same card, carry out a manual check to find out whether there are any unusual patterns emerging. Are there multiple payment addresses originating from the same IP? If so, this is a major red flag and an indication that you should not fulfil the transaction.

- Assess your transaction volumes. An unexplained large flow of transactions within a short time window might indicate a concerted attempt by criminals to use stolen cards on your site.

- Deploy 3-D Secure. Activate a 2-factor authentication process for each transaction, if you haven’t already done so, as this can help to protect you from being held liable in the event of a chargeback.

- Consult your merchant account provider. Contact your merchant processor for advice. The right merchant processor will offer you access to their wealth of knowledge and experience.

Final thoughts

While sending politicians to Mars might sound like a tempting idea, the potential cost of this noble project can help us put the losses to credit card fraud into perspective. Credit card fraud isn’t 100% avoidable. However, there is a lot merchants can do to protect their business.

Solutions as unique as

your business.